35 Candlestick Pattern PDF in Hindi: Free Download Guide to Master Trading in 2025

Candlestick patterns are essential tools for traders to predict stock market price movements. For Hindi-speaking traders, understanding these patterns in their native language can simplify learning and boost trading success. This comprehensive guide, inspired by resources like Share Market Edu, offers insights into all major candlestick patterns and provides a free “candlestick pattern PDF in Hindi” to help you master trading. Whether you’re a beginner or an experienced trader, this article breaks down bullish and bearish patterns, their significance, and practical tips for success.

Table of Contents

What is Candlestick Pattern ?

Candlestick patterns are visual representations of price movements on a stock chart, originating from Japanese trading techniques over 100 years ago. Each candlestick shows a stock’s opening, closing, high, and low prices within a specific timeframe (e.g., 15 minutes, 1 hour, daily). These patterns help traders identify market trends, reversals, and sentiment, making them crucial for intraday, swing, or options trading.

Why Learn Candlestick Patterns in Hindi?

- Clarity: Learning in Hindi eliminates language barriers, making complex concepts easier to grasp.

- Practicality: Hindi PDFs with visuals and examples simplify pattern recognition.

- Accessibility: Free resources like the “candlestick pattern PDF in Hindi” empower traders across India.

Types of Candlestick Patterns

Candlestick patterns are divided into two main categories: Bullish (indicating price increase) and Bearish (indicating price decrease). They are further classified based on the number of candles involved: single, double, and multiple candlestick patterns.

Single Candlestick Patterns

These patterns involve one candle and often signal trend reversals.

- Hammer: A bullish reversal pattern with a small body and long lower shadow, appearing after a downtrend. It indicates buyers pushing prices up from a low.

- Hanging Man: A bearish reversal pattern with a small body and long lower shadow, forming at the top of an uptrend, signaling seller dominance.

- Marubozu: A single candle with a long body and no shadows, indicating strong buying (bullish) or selling (bearish) pressure.

Double Candlestick Patterns

These involve two candles and are reliable for spotting reversals.

- Bullish Engulfing: A bullish pattern where a small bearish candle is followed by a larger bullish candle that engulfs it, signaling a trend reversal.

- Bearish Engulfing: A bearish pattern where a small bullish candle is followed by a larger bearish candle, indicating seller control.

- Piercing Pattern: A bullish reversal where a bearish candle is followed by a bullish candle that closes above the midpoint of the first candle.

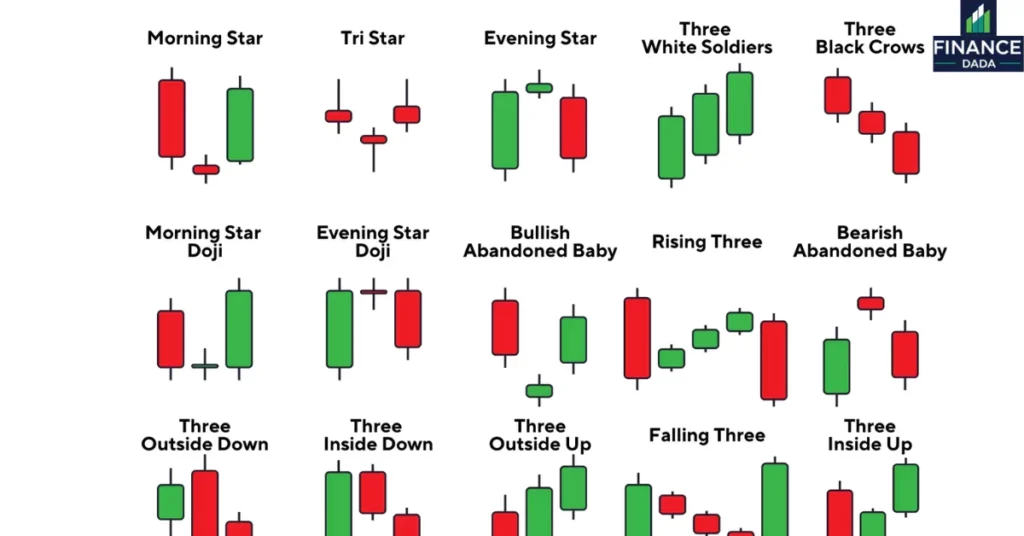

Multiple Candlestick Patterns

These involve three or more candles and are highly accurate for predicting trends.

- Morning Star: A three-candle bullish reversal pattern with a bearish candle, a doji (indecision), and a bullish candle, signaling a shift to an uptrend.

- Three White Soldiers: Three consecutive bullish candles with minimal shadows, indicating strong buying pressure after a downtrend.

- Three Black Crows: Three consecutive bearish candles with lower openings and closings, signaling a strong downtrend.

Candlestick Pattern Types Table

| Type | Pattern Example | Signal | Candles Involved |

|---|---|---|---|

| Single | Hammer, Hanging Man | Reversal | 1 |

| Double | Bullish Engulfing | Reversal | 2 |

| Multiple | Morning Star, Three Black Crows | Reversal/Continuation | 3+ |

35 Candlestick Patterns in Share Market

Below is a table of 35 candlestick patterns commonly used in the share market, categorized into Bullish, Bearish, and Continuation patterns.

| Bullish Candlestick Patterns | Bearish Candlestick Patterns | Continuation Candlestick Patterns |

|---|---|---|

| Bullish Engulfing | Bearish Engulfing | Doji |

| Hammer | Hanging Man | Falling Three Methods |

| Inverted Hammer | Shooting Star Pattern | Spinning Top |

| Morning Star Pattern | Evening Star Pattern | High Wave |

| Bullish Piercing Pattern | Dark Cloud Cover | Rising Three Methods |

| Three White Soldiers | Three Black Crows | Rising Window |

| Bullish Harami | Bearish Harami | Falling Window |

| Three Inside Up Pattern | Three Inside Down | Upside Tasuki Gap |

| Tweezer Bottom | Tweezer Top | Downside Tasuki Gap |

| Bullish Counterattack | Bearish Counterattack | Mat Hold |

| Three Outside Up | Bearish Marubozu | On-Neck Pattern |

| Bullish Marubozu |

Importance of Candlestick Patterns in Trading

Candlestick patterns provide insights into market psychology, helping traders:

- Predict Trends: Identify whether prices will rise (bullish) or fall (bearish).

- Spot Reversals: Recognize when a trend is likely to change direction.

- Time Entries/Exits: Make informed decisions on when to buy or sell.

- Enhance Strategies: Combine with indicators like moving averages for better accuracy.

Why Hindi Resources Matter

- Accessibility: Hindi PDFs cater to India’s millions of Hindi-speaking traders.

- Simplified Learning: Visuals and examples in Hindi make patterns easier to understand.

- Practical Application: Guides like the “candlestick pattern PDF in Hindi” include actionable steps for platforms like TradingView or Zerodha.

Benefits of Learning Candlestick Patterns

- Improved Decision-Making: Patterns help identify high-probability trades.

- Versatility: Applicable to intraday, swing, and options trading.

- Market Edge: Understanding patterns gives traders an advantage in volatile markets.

- Risk Management: Combining patterns with indicators reduces trading risks.

Common Mistakes to Avoid

- Isolating Patterns: Always confirm with volume or trendlines to avoid false signals.

- Ignoring Trends: A bullish pattern in a strong downtrend may fail.

- Lack of Practice: Backtest patterns using historical data to build confidence.

How to Use Candlestick Patterns in Trading

To effectively use candlestick patterns:

- Select a Timeframe: Use 15-minute, 1-hour, or daily charts on platforms like Zerodha or Upstox.

- Identify Patterns: Look for patterns like Hammer or Morning Star and confirm with volume.

- Use Indicators: Combine with moving averages, RSI, or support/resistance for accuracy.

- Practice: Use demo trading apps to test strategies without financial risk.

- Download Resources: Access a free “candlestick pattern PDF in Hindi” for detailed visuals and examples.

Platforms for Practice

- TradingView: Analyze patterns with customizable charts.

- Zerodha Kite: Execute trades with real-time pattern identification.

- Upstox: Offers user-friendly charting tools for beginners.

Additional Tips for Mastering Candlestick Patterns

Combine with Technical Analysis

- Moving Averages: Confirm trend direction (e.g., 50-day SMA).

- RSI: Gauge overbought/oversold conditions (30–70 range).

- Support/Resistance: Validate patterns with key price levels.

Backtest Strategies

- Use historical data to test pattern reliability.

- Focus on high-accuracy patterns like Morning Star or Three White Soldiers.

Stay Updated

- Follow market news to understand macroeconomic impacts.

- Join Hindi trading communities for real-time insights.

Free Candlestick Pattern PDF in Hindi

A comprehensive “candlestick pattern PDF in Hindi” is available for free download, covering:

- All 35 Patterns: Detailed explanations of bullish and bearish patterns.

- Visuals & Examples: Screenshots and real-time chart examples.

- Actionable Steps: Tips for applying patterns in trading.

- Beginner-Friendly: Written in simple Hindi for easy understanding.

Download 35 Powerful Candlestick Patterns in Hindi PDF

Click Below Button and Join Free Telegram Channel To Download Candlestick Pattern PDF in Hindi.

Candlestick Patterns FAQ

Q1: What is a candlestick pattern PDF in Hindi?

A: A free guide explaining all major candlestick patterns in Hindi, with visuals and examples to aid trading.

Q2: Why are candlestick patterns important for trading?

A: They help predict price movements, spot reversals, and time trades effectively.

Q3: Which candlestick pattern is most reliable?

A: Patterns like Morning Star and Three White Soldiers are highly accurate when confirmed with indicators.

Q4: How can I download a candlestick pattern PDF in Hindi for free?

A: Visit [your website’s link] to access a free PDF with 35 patterns and practical examples.

Q5: Are candlestick patterns effective for intraday trading?

A: Yes, especially on 15-minute or 1-hour charts, when combined with volume and indicators.

Q6: Can beginners use the candlestick pattern PDF in Hindi?

A: Absolutely, it’s designed in simple Hindi with visuals for easy learning.

Q7: How do I confirm candlestick patterns?

A: Use technical indicators like RSI, moving averages, or support/resistance levels for validation.

Also Read: Trading Kaise Sikhe: 2025 Mein Beginners Ke Liye Step-by-Step Guide

Disclaimer: Stock market investments are subject to market risks. Please read all scheme-related documents carefully before investing. All information provided on Finance Dada is for educational and informational purposes only. We do not guarantee the accuracy, completeness, or reliability of any information, figures, or opinions shared on this website. We are not SEBI registered and do not provide any investment advice or stock recommendations. Always consult a qualified financial advisor before making any investment decisions.